What is the impact of the change of gst to sst in malaysia. The GST Council recommended the Quarterly Return Filing and Monthly Payment of Taxes or QRMP scheme under GST in its 42nd meeting held on 5th October 2020 as a business.

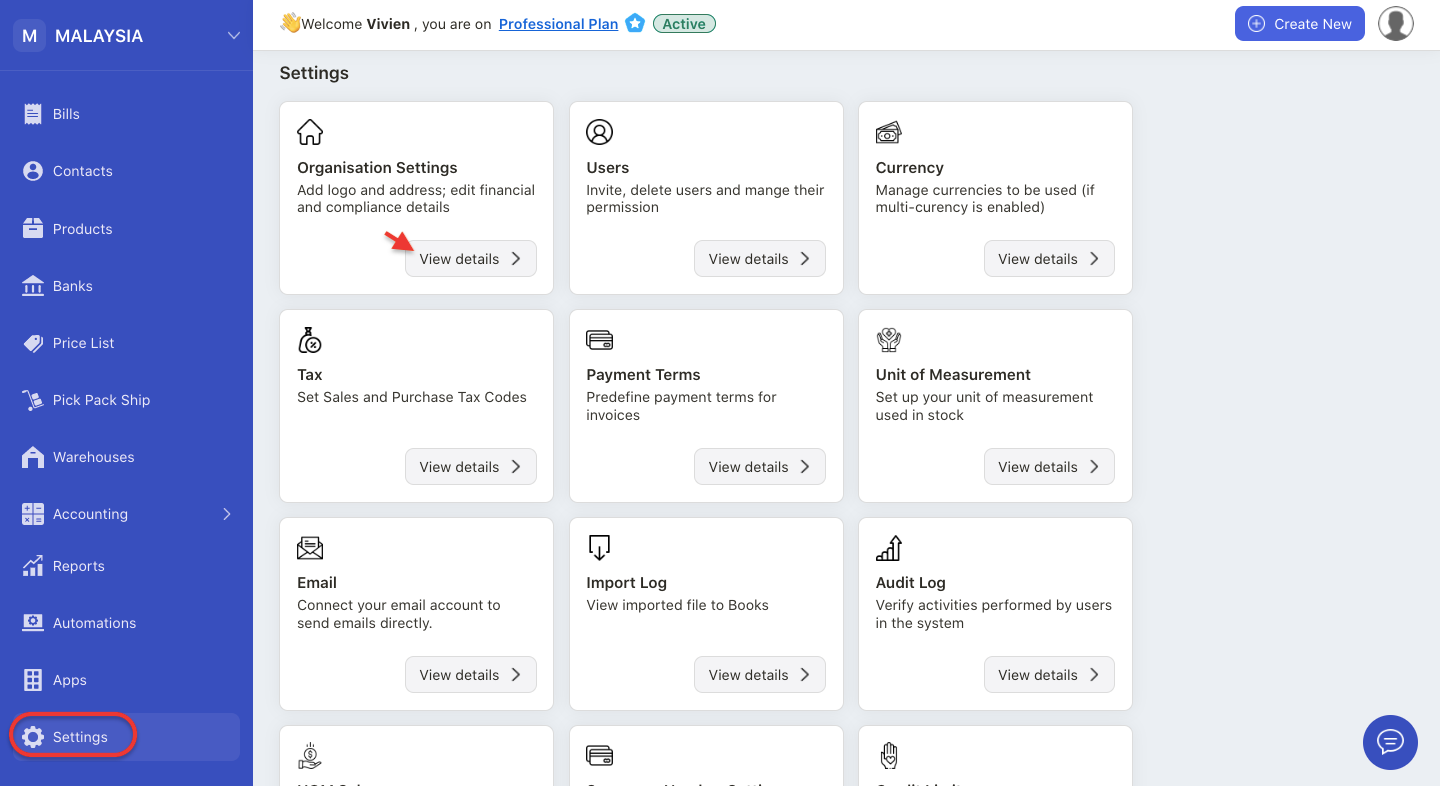

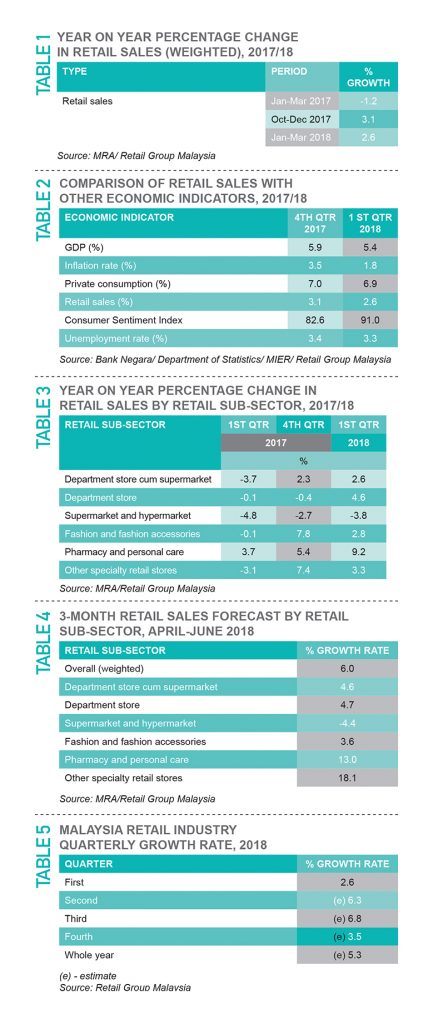

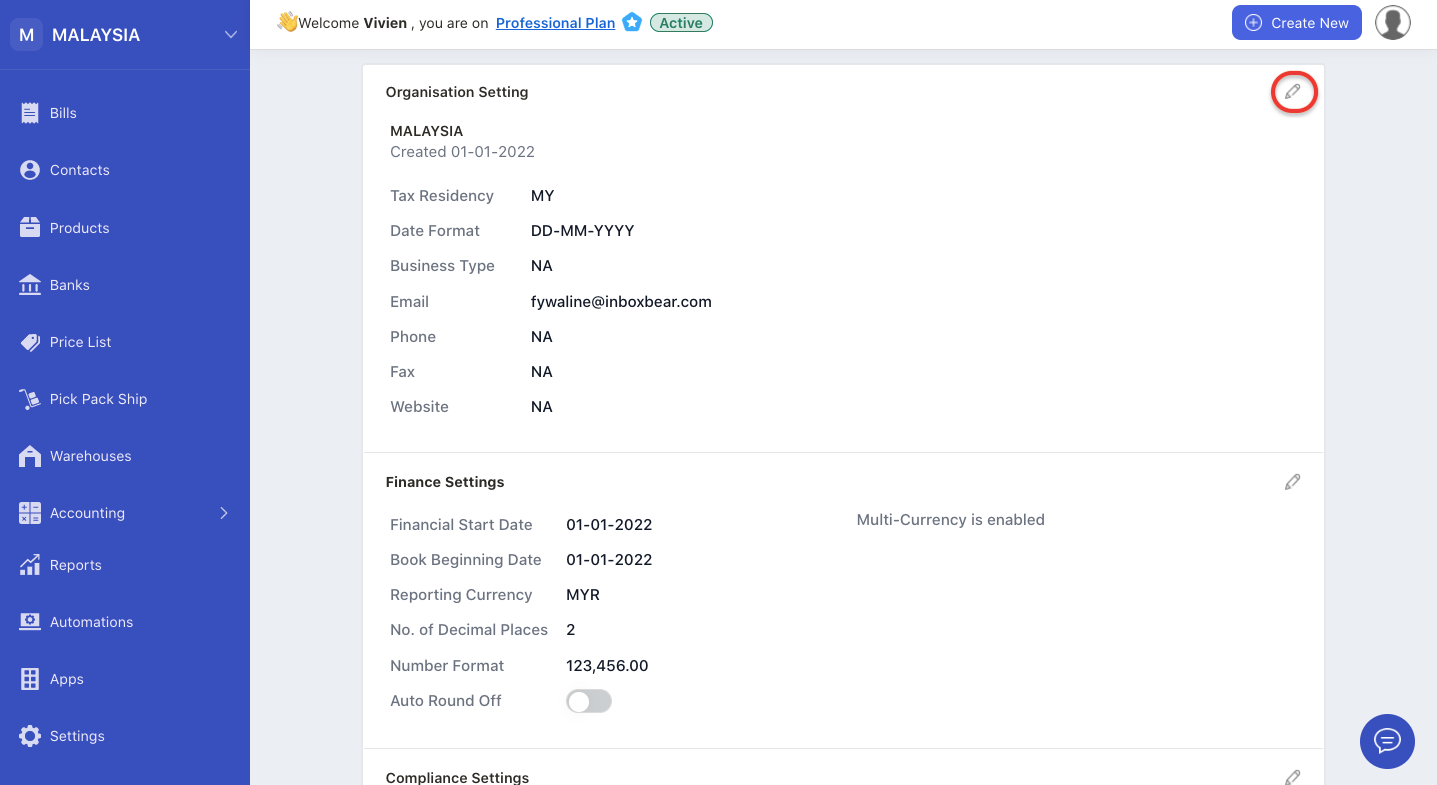

Malaysia How Can I Set Up My Company Using Deskera Books Plus

GSTR 20131 Goods and services tax.

. If your GST turnover is less than 20 million and we havent told you to report GST monthly you can report and pay GST quarterly. For instance a registrant with an annual filing requirement can elect to file on a quarterly or monthly basis and a registrant with a quarterly filing requirement can elect to file. We also require some.

Calculation Payment of tax. Review of the account. Here it is necessary.

A business not opting into the Quarterly Return and Monthly Payment of taxes QRMP. Management of Working Capital. However the government has recently introduced QRMP Scheme according to which if the turnover for a business for previous year is up to 5 crores you can pay your GST on monthly.

All persons not just. Creating monthly or quarterly gst return 03 automatically. Option to choose between Self Assessment Method Fixed Sum Method monthly depending upon fund availability.

12 returns for 12 months. 4 returns for 4 quarters. 4 returns for 4 quarters.

Gst monthly or quarterly malaysia. Only businesses registered under GST can charge and collect GST. Sahaj Sugam and Normal GST Monthly Quarterly Returns.

GSTR 1 Return Filing requires the taxpayer to furnish all the outward supplies sales data to the GST portal. Those companies that are achieving annual turnover above RM5 million the filing frequency will be increased to. Kindly note due dates of GSTR 5 6 7 and 8 for the month of June 2020 is extended to 31st August 2020.

Also due date of ITC 04 for March 2020. Amongst all the types of GST return GSTR 1 return filing is the most primary and. New Avtar of GST Monthly Quarterly Return filing system.

In case one choose not to follow the norm monthly or quarterly then one needs to apply to Director. 12 returns for 12 months. For annual turnover below RM5 million the frequency of filing is quarterly.

But was subsequently replaced with the Sales Service Tax in September 2018. At the onset of GST there was concept of filing. GST Return Monthly filing.

Businesses that are registered under gst have to file the. Update on Other Compliances. S401 of GST Act taxable period are normally monthly or quarterly.

If you report and pay quarterly you use one of three. Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers. Businesses that are registered under GST have to file the GST returns monthly quarterly and annually based on the business.

Such returns shall be filed in GSTR 1 and GSTR 3B forms on a quarterly basis while the payment of taxes shall be made on a monthly basis of every quarter using form PMT. The Goods and Services Tax was implemented in Malaysia commencing April 2015. If your GST turnover is 20 million or more you must report and pay GST monthly and lodge your activity statement electronically through Online services for business.

Business Activity Statements How To Take The Sting Out Of The Quarterly Payment David Unwin Accounting Tax Audit Services

Types Of Gst Returns And Their Due Dates Enterslice

Tax Compliance And Statutory Due Dates For April 2022 Ebizfiling

Gst Software Best Accounting Software In Malaysia Zahir

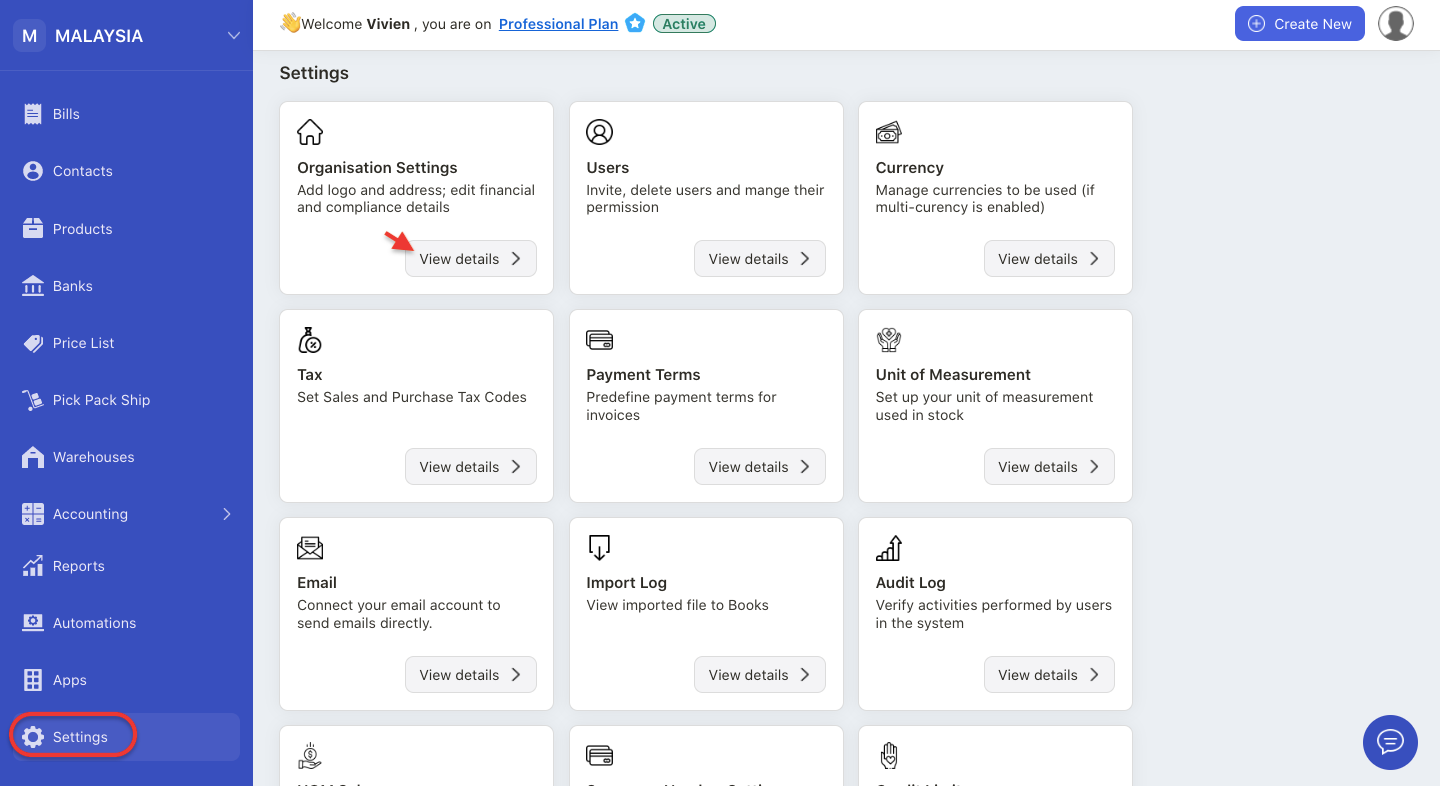

Malaysia Retail Industry Report Marketing Magazine Asia

Lalit Malik News Latest Lalit Malik News Information Updates Cfo News Etcfo

Tax Compliance And Statutory Due Dates For The Month Of August 2021

How To Work Out Your Gst Return Gst Bas Guide Xero Au

Sharing Zenflex Easy Zenflex Malaysia Gst Gaf Viewer Facebook

Gst Software Best Accounting Software In Malaysia Zahir

Electricity Tariff For S Pore Homes To Rise By 5 6 In 1q

Malaysia How Can I Set Up My Company Using Deskera Books Plus

Gst Software Best Accounting Software In Malaysia Zahir

Apajit Singha Guwahati Assam India Professional Profile Linkedin

Milin Parekh Partner Jhs Associates Llp Linkedin

Workplace Inspection Schedule Health And Safety Template Etsy India

Malaysia How Can I Set Up My Company Using Deskera Books Plus

How To Work Out Your Gst Return Gst Bas Guide Xero Au

Overview Of Gst E Filing Process Hlb Atrede